The Market Profile value areas and ShadowTrader Pivots for /ESU19 and /NQU19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

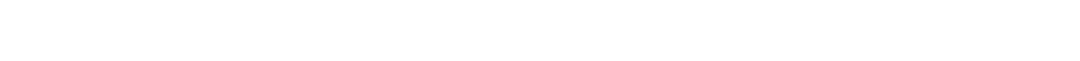

| 2890.50 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High |

|---|---|

| 2897.50 | Overnight HalfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level. |

| 2919.75 | ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. |

Huge double digit gap of almost 30 handles as I sit down to my typewriter (1989 Smith Corona XD 4600) this morning. Needless to say the open is slated to be out of balance and the gap is a true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More. Gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More are definitely in play.

If that sort of thing matters to you, China said overnight that they would not retaliate further with new tariffs.

Before we look forward as to how today might play out, I want to point out how strong of a signal the poor highA poor high is one which lacks excess and is the opposite of an excess high. A poor high will have less than two TPO's of excess at the top of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking top. It indicates that there are short term or weak handed longs at that high of day area. We know this because every time prices rise to the top, they get sold quickly, thus forming the poor high.

The poor high has two forward looking indications. The first is that prices should back away from the poor high as there are a number of longs trapped at poor location. The second is that if the next day or in some subsequent session, the poor high is revisited, then the odds are strong that it will break and move higher. This is called repair as it repairs the structur... from yesterday was. The flat top of ‘M’ and ‘O’ periods with no excess at all create the poor highA poor high is one which lacks excess and is the opposite of an excess high. A poor high will have less than two TPO's of excess at the top of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking top. It indicates that there are short term or weak handed longs at that high of day area. We know this because every time prices rise to the top, they get sold quickly, thus forming the poor high.

The poor high has two forward looking indications. The first is that prices should back away from the poor high as there are a number of longs trapped at poor location. The second is that if the next day or in some subsequent session, the poor high is revisited, then the odds are strong that it will break and move higher. This is called repair as it repairs the structur.... Then when the settlement at 4:15pm EST is right up against that level, it increases the odds greatly that futures will trade lower overnight. Note how the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. is 15 points below the settlement. The way to play this is to initiate a short right about 4:14pm EST if it appears that the settlement will be right up against the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high, then cover incrementally (at lower and lower levels) using limit orders overnight. Watch for this pattern, it is relatively rare but not unicorn rare. If that isn’t news you can use, I don’t know what is.

Now, let’s look forward… The gap is obviously enormous. Gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More are extremely important today. If you are new, then mouse over the tool tip and get yourself very familiar with this framework. I believe it is invaluable when trying to navigate these opens.

Beyond the rules, there is actually little to say here. The strongest potential today is for the gap to just hang at the top (gap rule #4) and digest the overnight activity. That is the most common outcome to gaps that are this large. Novice traders (and I used to do this too!) focus on the size of the gap and believe that shorting it early has excellent risk/reward because their stop is small relative to the their target. While that’s true, it’s also true that the trade itself has low probability of working out. This is am important point that a lot of traders miss. If the expectancy of winning is very low and causes multiple stop outs, then who cares how good the risk reward is?

Your focus this morning should be on market internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. more than price. If the tickThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. doesn’t get negative early, then the gap is not going to fill. If the A/D line is pegged at > +1500 after 30 minutes of trade, then the gap is probably not going to fill. If early corrective activity is of the slow grind variety, then that is also a sign that the gap is not going to fill. All of the above usually leads to either very little rebalancing or a partial gap fill. As such I’ve put overnight halfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level. on the key levels.

If it is a gap and go scenario today, then the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. is the obvious gateway to higher prices and needs to be taken early on strong tempoProbably one of the most important and yet overlooked concepts in the market. The tempo is simply the ‘speed’ at which the market is moving. This is also referred to as confidence. Slow tempo is typical of range bound days where there is lots of responsive activity. Fast tempo occurs when there is initiating activity, and market is breaking out of a range. This is not to say that the market can’t have fast tempo on days when it is rotational or moving between the extremes of a value area. It certainly can. Effective intraday futures trading involves gauging the tempo and knowing that opportunities are fewer and smaller when the tempo is slow. See S.O.H. and bullish internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick.. Keep in mind that this trade is also tricky because you are buying after a 30 point move (overnight) has already happened.

Keep in mind that I am telling you only what has strongest probability of occurring from my considerable experience in these matters. Could sellers come in immediately and fill the gap quickly? Without a doubt. BUT and this is a very big but……there will be signals that will confirm this. The tickThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. will plunge right away and advance declineThe advance decline line for the NYSE or Nasdaq. This is a figure composed of a net sum of the number of advancing stocks minus the number of declining stocks at any given moment in each of the two respective markets. lines will start moving down sharply towards the zero lineA term we use to indicate parity in the internals. For instance if the breadth goes flat (advancing volume is equal to declining volume), we say its sitting at the ‘zero line’. We use this for breadth and also for the advance decline line. from the open. This doesn’t have to be a guessing game. You would not drive your car and think “Gee, I wish I knew how fast I was going”, you would just look at the speedometer.

Scenarios

- Given the large gap, my focus this morning will be on the quality of early selling and whether or not there is any meaningful gap fill. I will note all internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. readings at open and monitor them constantly to see if any corrective activity is occurring. A common play that I use on these days is to buy the high of the first one minute bar in tech stocks or if there is an early fadeWhen a stock moves opposite the direction of its gap on an intraday basis, wait to buy when prices cross back through the open with a stop under the LODLow of Day. I feel strongly that individual stocks are the better play over futures on these days. FWIW, I generally don’t take the fadeWhen a stock moves opposite the direction of its gap on an intraday basis trade on these days as the odds don’t favor it.

Have a traderific Thursday,

Peter

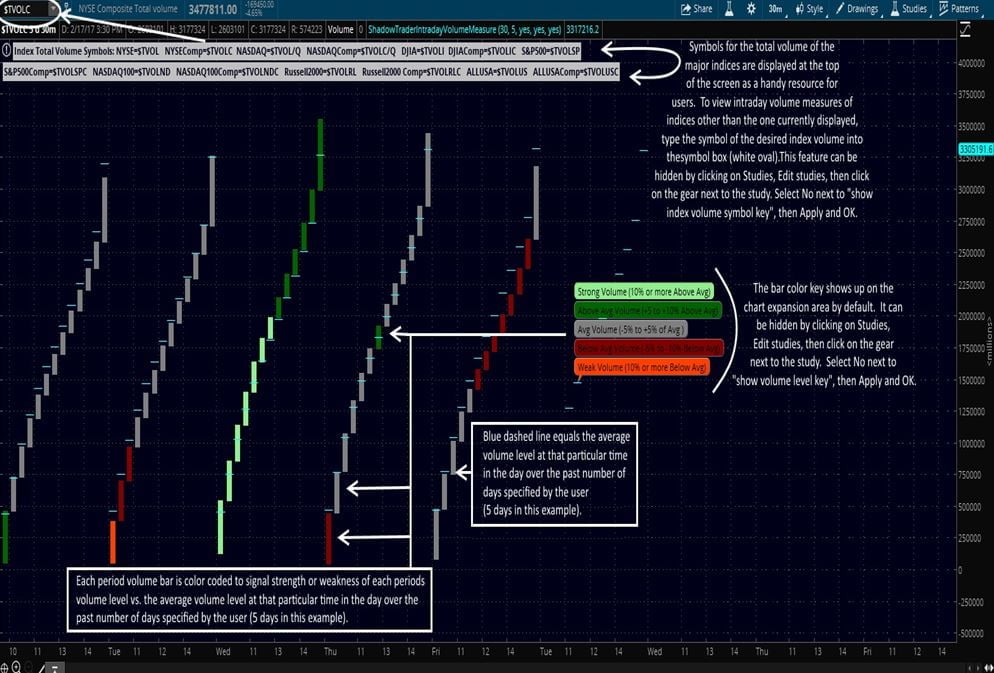

ShadowTrader Intraday Volume Measure

COMPARE INTRADAY VOLUME IN ANY TIMEFRAME

Fully Customizable Settings!

$20 Buy Now