The Market Profile value areas and ShadowTrader Pivots for /ESM20 and /NQM20 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

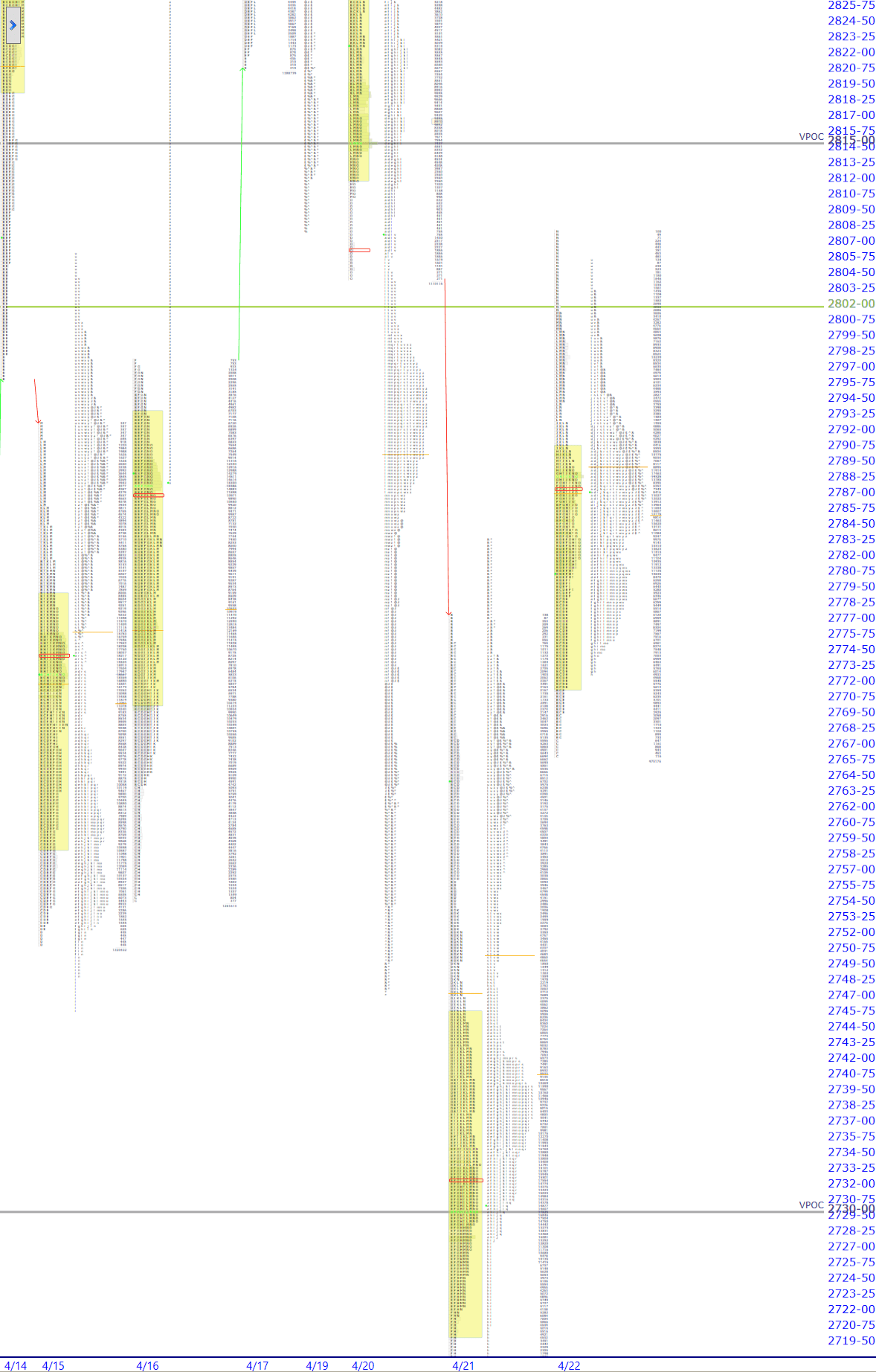

| 2815.00 | VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. 4/20 |

|---|---|

| 2808.00 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High |

| 2787.50 | Settlement |

| 2766.25 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low |

**I am on the ShadowTrader SquawkBox all day for Brad today. Stop by if you can.**

Always good to refresh on the three questions1. What is the market doing? (This is the general tone and bias that is currently in play)

2. What is the market trying to do?

3. How good of a job is the market doing getting there? you should ask yourself before every open.

1. Are we opening in or out of balance?

2. Is overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... net long or net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

and if so how much?

3. Where is current price in relation to the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. and ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day.?

The answers today would be IN, NEITHER, and NEAR THE HIGH. I also like to note if the overnight range is entirely within the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. or was there price exploration outside of it. Last night’s overnight distribution is completely inside of the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range which just indicates more balance. From just this M.G.I.Market Generated Information. we already have enough to know that the market does not currently have enough information to move higher or lower and thus opportunities will probably develop later rather than earlier.

Do you see how this is far superior to wondering what the payroll numbers are going to be and then thinking that if they are like this, then I’ll do that, and if they are like that then I’ll do this?

While there is little to go on so far as far as how today will play out, we do have plenty of M.G.I.Market Generated Information. to add to our narrative from yesterday. Yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. trade filled the gap but not much more and then sold off hard in late trade. This is noteworthy as the market did what it was supposed to do (fill the gap) but as of now was not able to find new buyers to take it further. We add that to our narrative in the slightly bearish column.

Also in the bigger picture we should look at where we are technically in the SPX and NDX because they are quite disconnected currently which will also add to the indecision intraday as the weaker index acts as a drag on the stronger one which tends to curtail moves.

SPX Daily with Fibonacci Retracement and Trendline from swing low

NDX Daily with Fibonacci Retracement and Trendline from swing low

A close look at the charts above shows that the SPX is trading around the 50% Fib level while the NDX is trading around the 61.80% level. The SPX has also broken its uptrend while the NDX is still intact. All of that is contributing to the current push-pull that creates ranges. If the NDX were to break down below its ascending trendline, that would be a stronger bearish signal. A continued hold for the NDX above the trendline increases odds that it moves higher. Note that currently, that index is going to be heavily influence by tech and FAANG earnings. We have gotten NFLX thus far and although results were strong, the stock didn’t react. That in and of itself is just one very small data point but I make note of it nonetheless. In this game it’s good to be a hoarder of information.

Scenarios

- While the 8:30 numbers strengthened futures considerably, we are still trading within yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range with an overnight session that has had very little price exploration. Thus the first scenario is to assume further balance and responsive tradeA responsive trade is a counter-trend trade taken against a specific level. The theory is that when two sided trade is taking place, there will not be enough momentum to push past key levels and buyers or sellers will respond to those areas, essentially pushing prices away from them. This is the opposite of breakout or initiative trade which is more directional in nature and is generally taken in the direction of the prevailing trend. can be the M.O.

- As the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. is pretty close to the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High, I will only look at the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High as a potential upside breakout point. If so, the VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. at 2815.00 is the first target, assuming context confirms.

- For today, I’ll use the same criteria as above on the downside. Because of the nature of the overnight range, only a move below the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low would have me thinking short for a larger trade.

ShadowTrader Cumulative Tick

Beef up your "quad" and by putting your tickThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. indicator on steroids!

Learn More