The Market Profile value areas and ShadowTrader Pivots for /ESH21 and /NQH21 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

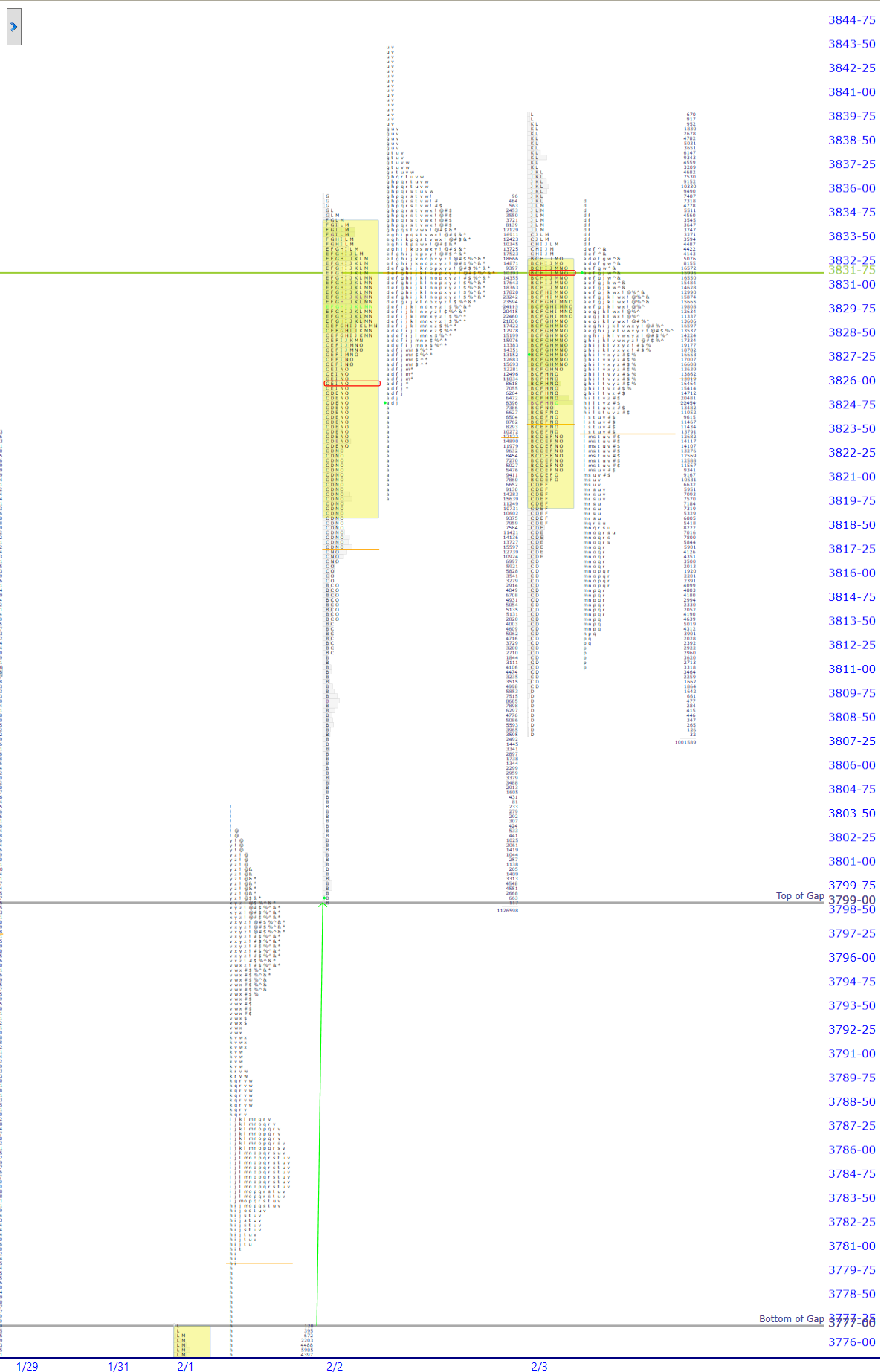

| 3843.50 | ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. (2.2) |

|---|---|

| 3840.00 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High |

| 3807.75 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low |

| 3799.00 | Top of Gap |

| 3777.00 | Bottom of Gap |

Completely unchanged valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More yesterday which signals that these recent higher prices are certainly being accepted. The gap below us remained unfilled and the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low entered the realm of the single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. but didn’t traverse very far, leaving about half of them untouched. Carry that forward as WWSHDWhen What Should Happen Doesn't - A market dynamic where prices defy what is normally expected of them given the specific context they are in. A good example would be filling a larger gap only partially. The thinking is that the failure to do what should happen means prices are potentially headed in the other direction..

Coming into today’s session we have a market clearly opening within range, both yesterday’s and the prior day on overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... that is close to 100% net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

. Current prices are very close to the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day.. All that tells us a good deal of M.G.I.Market Generated Information. as we know that RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. sellers were muted on yesterday’s expected liquidation breakA sudden selloff in the market that has the following characteristics:

-Often happens very early or late in the day

-Comes out of a pattern that doesn’t suggest such a break should occur

-Has no definitive catalyst or news that drives it

-Has much faster tempo than the one that has already been established

-Is often short-lived and will retrace 100% soon after or the next day

A liquidation break happens when short term traders get overly long and all panic out at once. It is different from a stronger, more lasting correction in that there are usually only very short timeframe players involved, usually those who got most recently long at poor location. and didn’t catch traction overnight either. Note in the market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. graphic above how the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. is higher than the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low.

All of that tells us that in today’s session the path of least (or perhaps lesser) resistance is higher and not lower. Yesterday’s liquidation breakA sudden selloff in the market that has the following characteristics:

-Often happens very early or late in the day

-Comes out of a pattern that doesn’t suggest such a break should occur

-Has no definitive catalyst or news that drives it

-Has much faster tempo than the one that has already been established

-Is often short-lived and will retrace 100% soon after or the next day

A liquidation break happens when short term traders get overly long and all panic out at once. It is different from a stronger, more lasting correction in that there are usually only very short timeframe players involved, usually those who got most recently long at poor location. took potential sellers out and so did the overnight activity which has been rebuffed.

Scenarios

- Potential for upside is there in today’s session. Add the overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... position to all the dynamics discussed above. Any upside move over that 2.2 overnight high would also represent a break out from two days of balance. Remember that we speak in terms of potential, not absolutes and that continued balanced can also be an outcome.

- Continue to carry forward the recent unfilled gap as having the potential to bring about change if tested.

Forex Trading Strategies by Blake Young

Use Blake's techniques to create trading systems

Over 4 1/2 hours of instruction

Applicable to all markets (stocks, futures, forex)