A market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. term that Peter often calls out in the Weekly Options room.

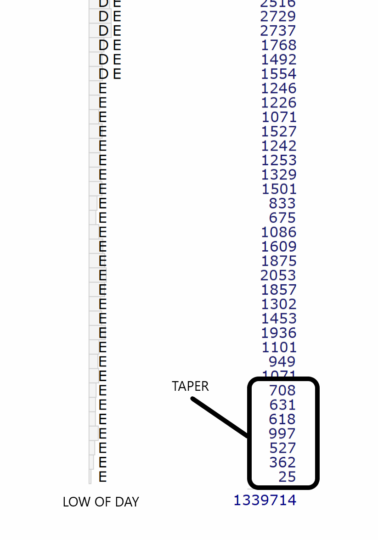

The “taper” is the tapering off of contract volume in the /ES as it moves to either the high or low of the day. Almost all highs and lows of a session are characterized by a diminishing of volume as price gets closer to the ultimate low or high of the day.

By the end of a regular trading hours session, almost every contract level will have at least 1,000 cotracts traded at it with many of the levels having over 10,000. The taper occurs when you start to see contract sizes per price level less than 1,000 and very often less than 100 on the exact high or low of the day.

The taper is a strong trading signal that the move underway may be over and the high or low of the day has been put in. When the taper is punctuated with a very low number of contracts (below 100) at the high or low, it’s an even stronger signal. Highs and lows of RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. sessions in the /ES very often have less than 100 contracts traded at them.