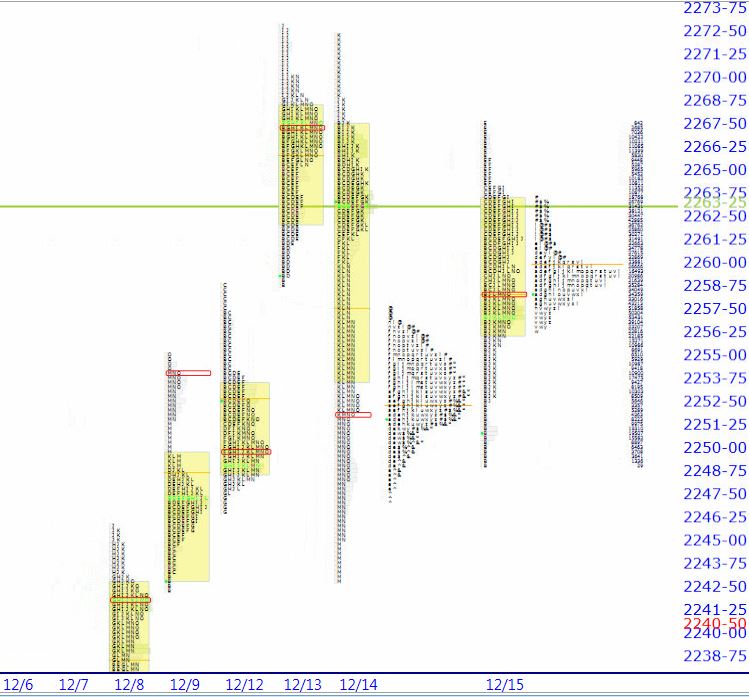

Market ProfileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. ValueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More Areas and POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. figures for /ESH7 and /NQH7 Futures are posted free every morning HERE. Click on any posts in the list on the left pane to see them in the main window. Don’t click on the ST logo as it will just refresh the page and you’ll get only the topmost post over and over. Click on the title or text.

Futures trading +4.25 as of this writing and trading completely inside the value areaA range where approximately 70% of the prior days volume traded. The range is derived from one standard deviation on either side of the mean which is roughly 70%. See: Market Profile. Note how the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. and ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. match up quite perfectly with the VAHValue Area High and VAHValue Area High. I discussed this on tastytrade yesterday as a market that is “acting right” and balancing before probably moving higher. If you’ll recall yesterday’s blog predicted an inside dayA day in which the entire range of price action from lows to highs is within or inside the prior day’s range. This pattern in candlestick terms is called “harami” and is a sign of a small pause in the prevailing trend before continuing onward rather than reversing. with opportunity at value areaA range where approximately 70% of the prior days volume traded. The range is derived from one standard deviation on either side of the mean which is roughly 70%. See: Market Profile extremes and that’s exactly what we got.

Consider yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low and high (2249.25 and 2267.75) as your reference points for today’s trade. Only a move beyond those points brings about the chance of a larger change. Overall, I think the market has more balancing to do as the post-election advance is so large and we’ve just started digesting it. That being said, I would be on the lookout for the look above or below trade where prices might move outside of yesterday’s range and then enter back in. InternalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. and context would be the arbiters as always.

Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is just slightly net long and as touched upon above, pay close attention to VAHValue Area High and VALValue Area Low as overnight action has turned there all night.

Have a wonderful day,

peter