The Market Profile value areas and ShadowTrader Pivots for /ESZ20 and /NQZ20 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

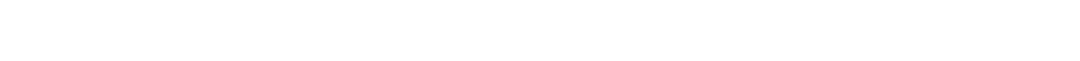

| 3376.25 | Top of Gap |

|---|---|

| 3349.75 | ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. |

| 3333.75 | Bottom of Gap |

| 3323.50 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High |

| 3299.25 | Settlement / ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. |

Solid true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More higher on this election day. Gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More are in play.

Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is 100% net long and as of now we are slated to open in the upper third of the overnight range.

There is a large unfilled gap above yesterday’s range into which overnight activity has ventured forth. This is simply a carry forward to know that we are opening inside of a gap. Only RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. activity counts towards actually repairing this structure.

If there is any early fadeWhen a stock moves opposite the direction of its gap on an intraday basis, the bottom of the gap could be a support point where stronger buyers emerge. Keep that in mind as a Key Level today.

While it’s a long way away from current price, I must mention that yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low is one to carry forward into your narrative. The low was both poor and weak. It is a poor lowA poor low is one which lacks excess and is the opposite of an excess low. A poor low will have less than two TPO's of excess at the bottom of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking bottom. It indicates that there are short term or weak handed shorts at that low of day area. We know this because every time prices sell off to the low, they get covered quickly, thus forming the poor low.

The poor low has two forward looking indications. The first is that prices should bounce away from the poor low as there are a number of shorts trapped at poor location. The second is that if the next day or in some subsequent session, the poor low is revisited, then the odds are strong that it will break and move lower. This is called repair as it repairs the ... due to lack of excess and it is a weak lowA weak low should not be confused with a poor low. The latter speaks to a deficiency in structure and the former deals with the location of the low. A weak low is formed when a market falls and reverses right at a specific point which is often a technical or profile nuance. Some examples would be prior intraday lows, the lower extreme of a value area, the prior day's settlement, or the current day's open. In each case, the location is a mechanical and visual reference that is used by short term traders as an entry point. The low is deemed weak because it can be taken easily when retested due to the short term nature of the buyers who initiated their positions at that level. because it stopped dead on the prior RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session’s settlement. Mark it off on your charts as it will be a good short should it ever be tested again.

As this is the last RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session before the election, expect some craziness as players jockey for position ahead of the results. Very difficult to say how futures will react this evening, so comport yourselves accordingly.

Scenarios

- Gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More are in play. As such, the first scenario is always the potential fadeWhen a stock moves opposite the direction of its gap on an intraday basis. Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is 100% net long and we are well out of range so the setup is there. Look for early failure to take out the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. and/or crosses back below the open after any opening drive higher. Monitor for continuation and consider the Bottom of the Gap as potential support.

- The upside gap should fill at some point and that could be today. If this is the scenario, then the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. will get taken on strong tempoProbably one of the most important and yet overlooked concepts in the market. The tempo is simply the ‘speed’ at which the market is moving. This is also referred to as confidence. Slow tempo is typical of range bound days where there is lots of responsive activity. Fast tempo occurs when there is initiating activity, and market is breaking out of a range. This is not to say that the market can’t have fast tempo on days when it is rotational or moving between the extremes of a value area. It certainly can. Effective intraday futures trading involves gauging the tempo and knowing that opportunities are fewer and smaller when the tempo is slow. See S.O.H. and bullish internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. and traders should monitor for continuation.

- Anything more playable to the downside would be presaged by a failure to hold above the Bottom of the Gap and subsequent full gap fill that then finds acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More within yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range.

A Bet and a Victor eBook

Best way to dip your toe into the ocean of Trading Psychology for a tiny price. Follow protagonist Victor and see how many of his trading psychology pitfalls you recognize!

$20 - Get Yours Today