The Market Profile value areas and ShadowTrader Pivots for /ESH21 and /NQH21 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

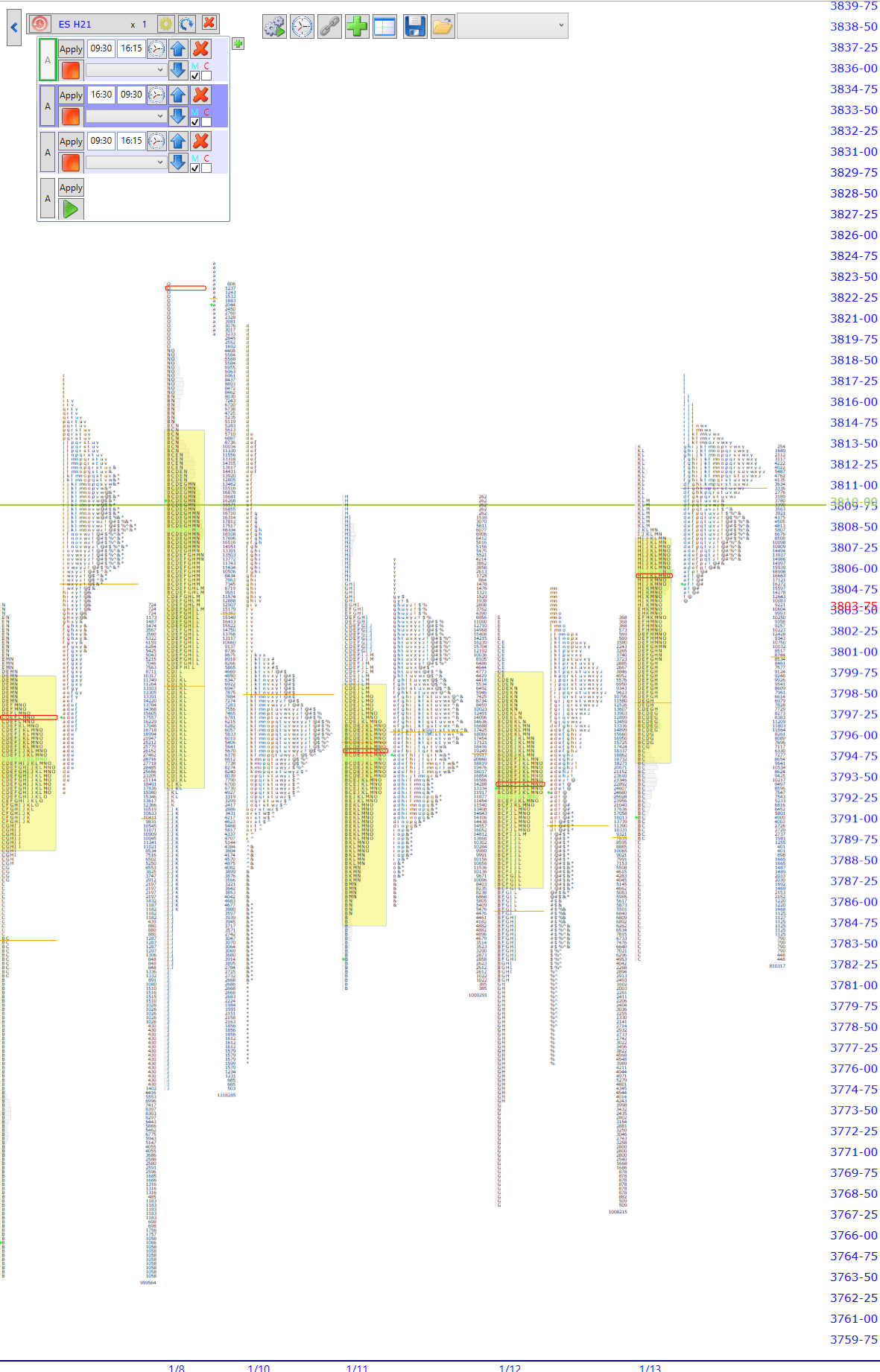

| 3824.50 | ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. / New ATHAll Time High |

|---|---|

| 3817.75 | ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. |

| 3806.00 | POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. / Settlement |

| 3804.25 | ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. (45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t...) |

Overnight activity is very compressed with little range to show for an entire evening’s work by the Globex crowd. As of now we are still trading within the prior day’s range and also within the larger balance area that we discussed yesterday. Continue to carry that forward in your narrative. Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is close to 100% net long and we are currently trading in the middle to lower third of the overnight range.

The overnight distribution has a 45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t... from it’s lows. As always, less import than seeing the same pattern in an RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session but worth noting nonetheless. Assume the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. could be secure in today’s trade.

Overall, there continues to be little to say as the market remains within balance. Balance rulesWhen a market is in balance, meaning that it is consolidating in a tight range of two or more days, then balance rules apply. The balance rules are nothing more than a framework of scenarios that could happen which prepare us for every possible outcome.

The possible outcomes and how to trade them are:

1. Look above and go. Prices move above the high of balance and find acceptance and continue higher. The target should be double the balance area.

2. Look above and fail. Prices move above the balance high but fail to find acceptance and reverse back into the balance area. This is now a short with a stop above the high just outside of balance that was recently made, with a target to the opposing low end of the balance area.

3. Look below and go. Prices move below the ... continue to be in play for this larger multiday range. ValueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More has been little changed over the last five RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. sessions.

The second scenario is left over from yesterday’s PPP by design as it’s still as relevant as yesterday.

Scenarios

- There is some potential that the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. remains secure in today’s session due to the overnight pattern. I would bias long unless that ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. is taken out. I am keeping firmly in mind that for now overnight traders were not able to get any major upside breakout going and the session has been relatively muted

- Assume further balance while we remain within the balance area. Balance rulesWhen a market is in balance, meaning that it is consolidating in a tight range of two or more days, then balance rules apply. The balance rules are nothing more than a framework of scenarios that could happen which prepare us for every possible outcome.

The possible outcomes and how to trade them are:

1. Look above and go. Prices move above the high of balance and find acceptance and continue higher. The target should be double the balance area.

2. Look above and fail. Prices move above the balance high but fail to find acceptance and reverse back into the balance area. This is now a short with a stop above the high just outside of balance that was recently made, with a target to the opposing low end of the balance area.

3. Look below and go. Prices move below the ... are in play. Go with any breakout from balance that has corresponding context of internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. and tempoProbably one of the most important and yet overlooked concepts in the market. The tempo is simply the ‘speed’ at which the market is moving. This is also referred to as confidence. Slow tempo is typical of range bound days where there is lots of responsive activity. Fast tempo occurs when there is initiating activity, and market is breaking out of a range. This is not to say that the market can’t have fast tempo on days when it is rotational or moving between the extremes of a value area. It certainly can. Effective intraday futures trading involves gauging the tempo and knowing that opportunities are fewer and smaller when the tempo is slow. See S.O.H.. Price action remaining within balance should be treated as responsive tradeA responsive trade is a counter-trend trade taken against a specific level. The theory is that when two sided trade is taking place, there will not be enough momentum to push past key levels and buyers or sellers will respond to those areas, essentially pushing prices away from them. This is the opposite of breakout or initiative trade which is more directional in nature and is generally taken in the direction of the prevailing trend. only.

ShadowTrader Trading Psychology Series

7 Hours & 19 Minutes of Video Lessons:

8 Modules in HD streaming (rewatch as often as you like)

Extensive .pdf workbook to print out and follow along as you learn

Much More!